Overview

With the aim of supporting capacity building and talent development for banking professionals, the Hong Kong Monetary Authority (HKMA) has been working together with the banking industry to introduce an industry-wide competency framework - “Enhanced Competency Framework (ECF) for Banking Practitioners” in Hong Kong.

The Enhanced Competency Framework on Green and Sustainable Finance (hereinafter referred to as “ECF-GSF”) is a non-statutory framework which sets out the common and core competences and capabilities required of practitioners who are performing functions related to GSF in the banking industry in Hong Kong.

With reference to the HKMA’s Guide to Enhanced Competency Framework on Green and Sustainable Finance, the objectives of the ECF-GSF are twofold:

-

To develop a sustainable talent pool of GSF talent for the banking industry; and

-

To raise the professional competence of practitioners who are performing functions related to GSF in the banking industry.

Although the ECF-GSF is not a mandatory licensing regime, authorized institutions (AIs) are strongly encouraged to adopt it for purposes including but not limited to:

-

Serving as a benchmark for accessing and enhancing the core competence of relevant practitioners;

-

Supporting relevant employees to attend the required trainings and assessments in order to obtain the certifications under the ECF-GSF;

-

Supporting the continuing professional development (CPD) of individual employees;

-

Promoting the ECF-GSF as an industry-recognised qualification, including for recruitment purposes.

For more details, please refer to the HKMA's Guide to Enhanced Competency Framework on Green and Sustainable Finance.

Who is ECF-GSF for?

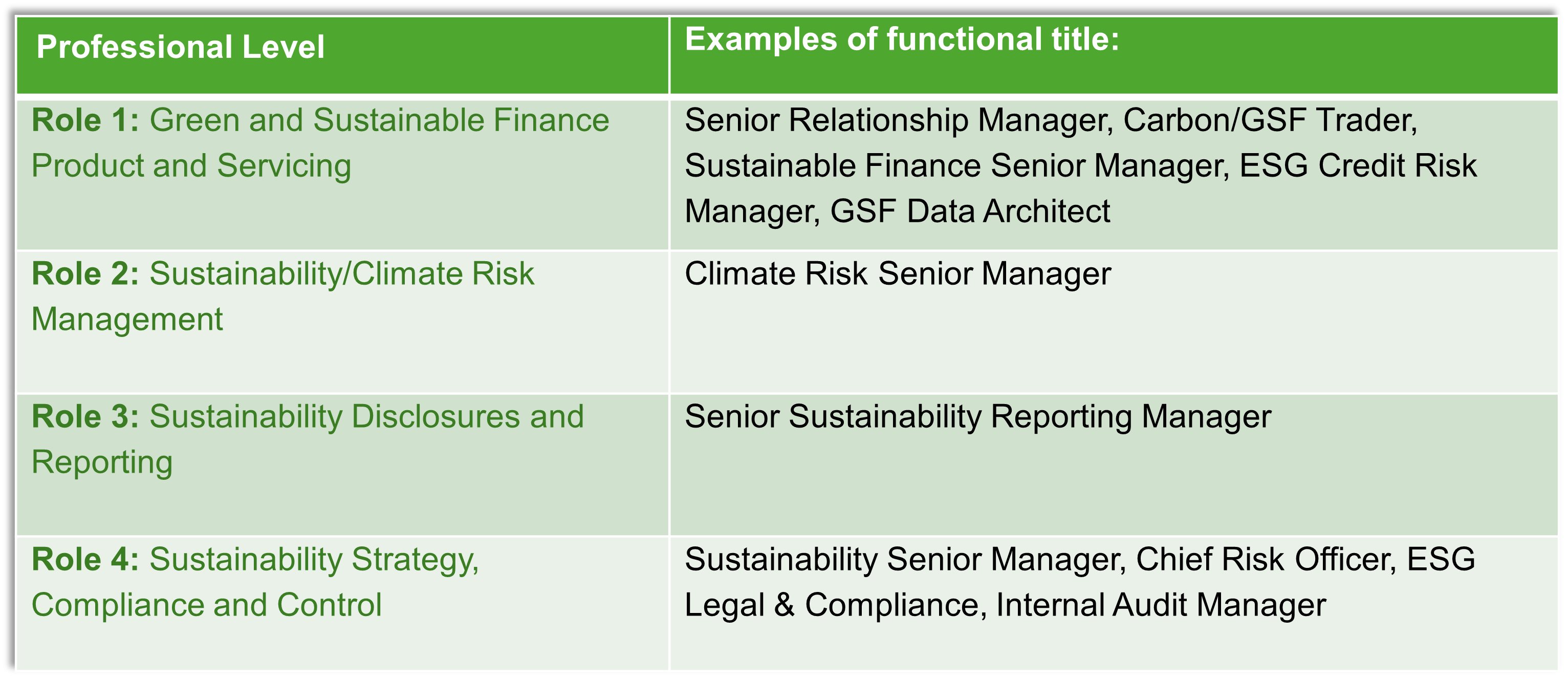

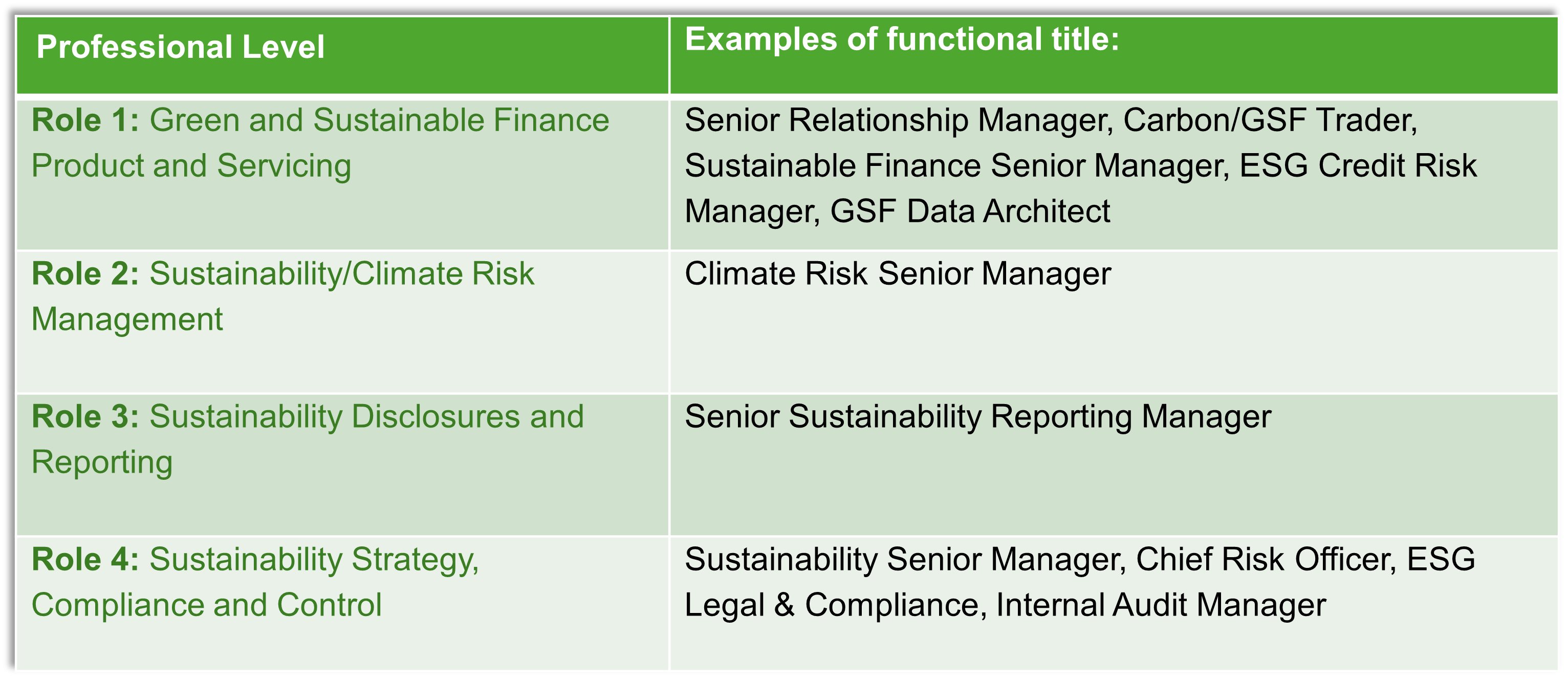

The framework applies to practitioners working in roles related to GSF within AIs. These roles include:

(For Core Level, please click HERE.)

HKIB’s Role in ECF-GSF

The HKIB is the administrator of the ECF-GSF, whose major roles including handling certification and grandfathering applications, providing the training programmes, administering the examinations and CPD requirements, and maintaining a public register of qualified certification holders.

Programme Structure

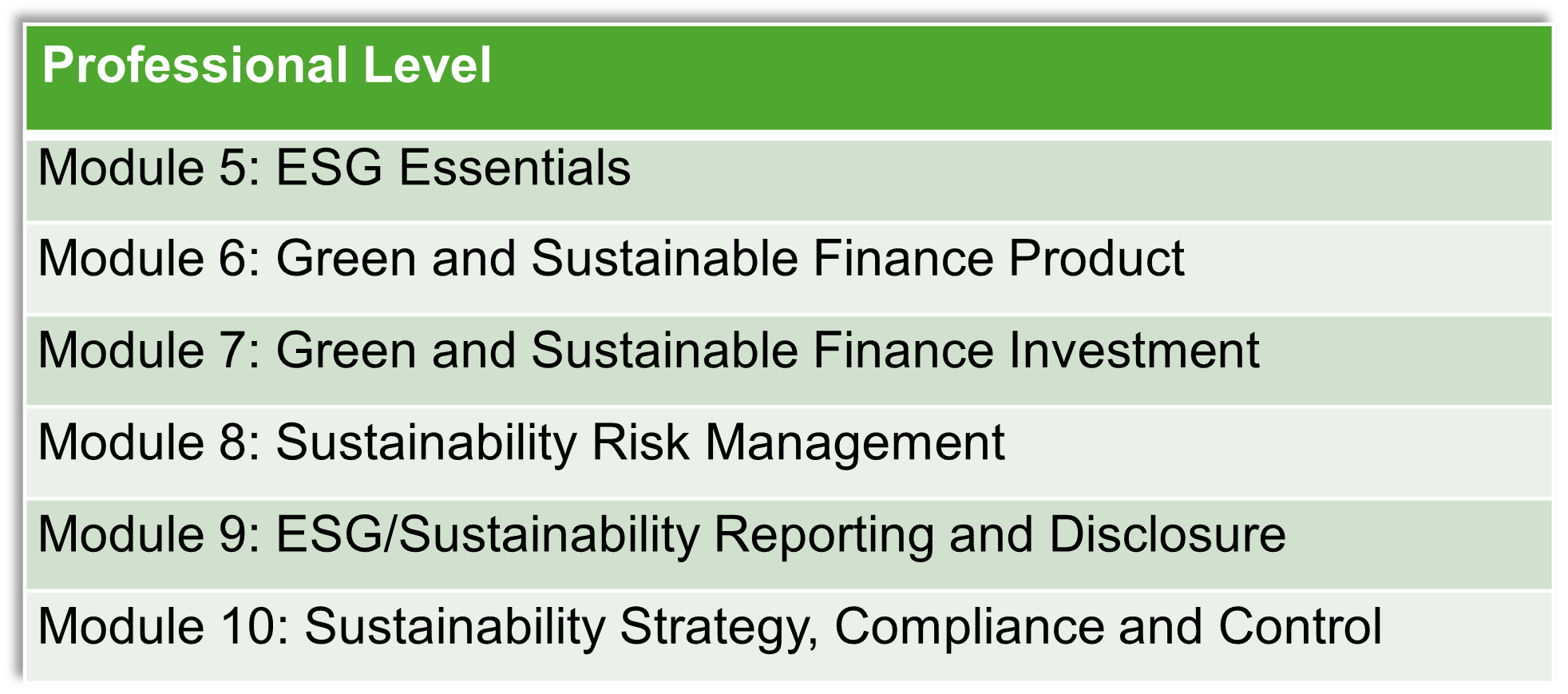

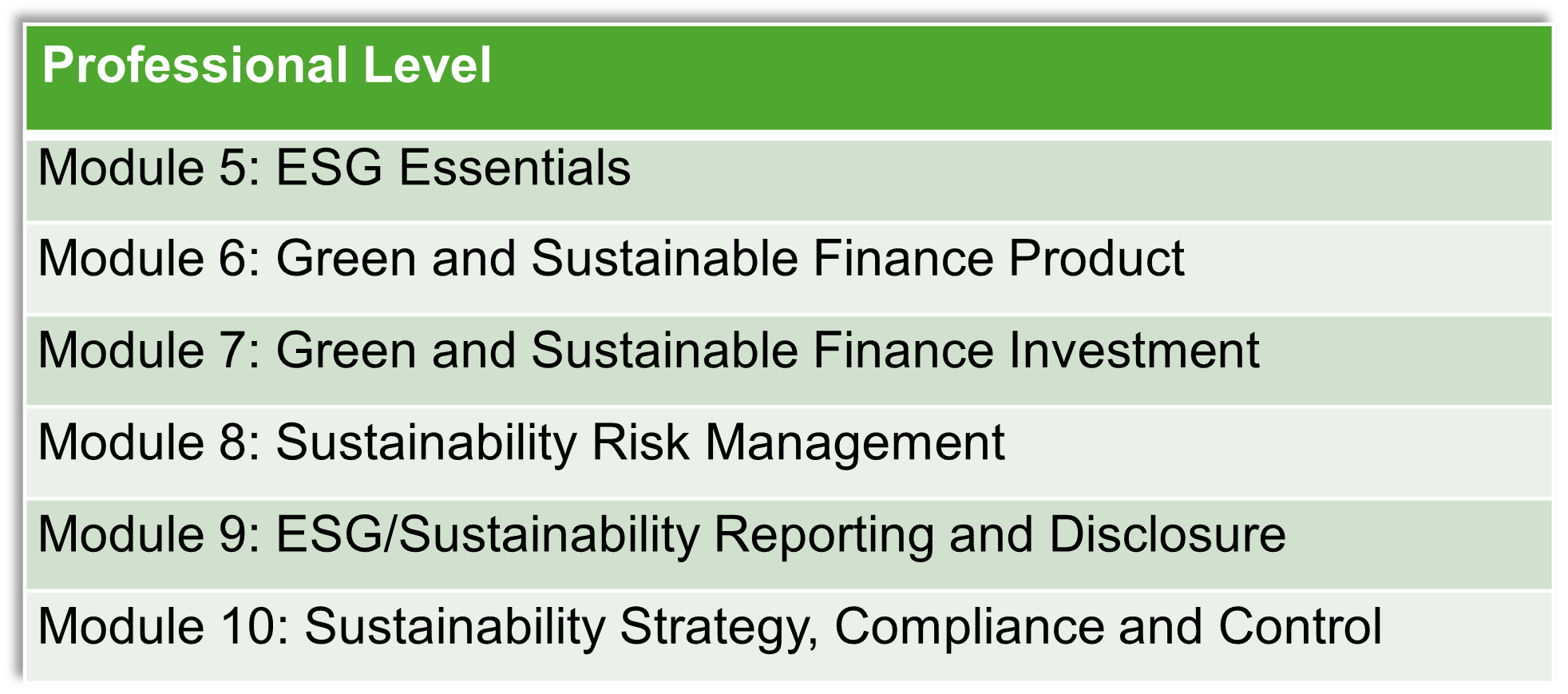

The ECF-GSF has two competency levels: Core Level (benchmarked at QF Level 4) and Professional Level (benchmarked at QF Level 5).

(For Core Level, please click HERE.)

Detailed programme structure including module outline, contact hours and examination format can be found in the ECF-GSF Programme Handbook which will be released soon.

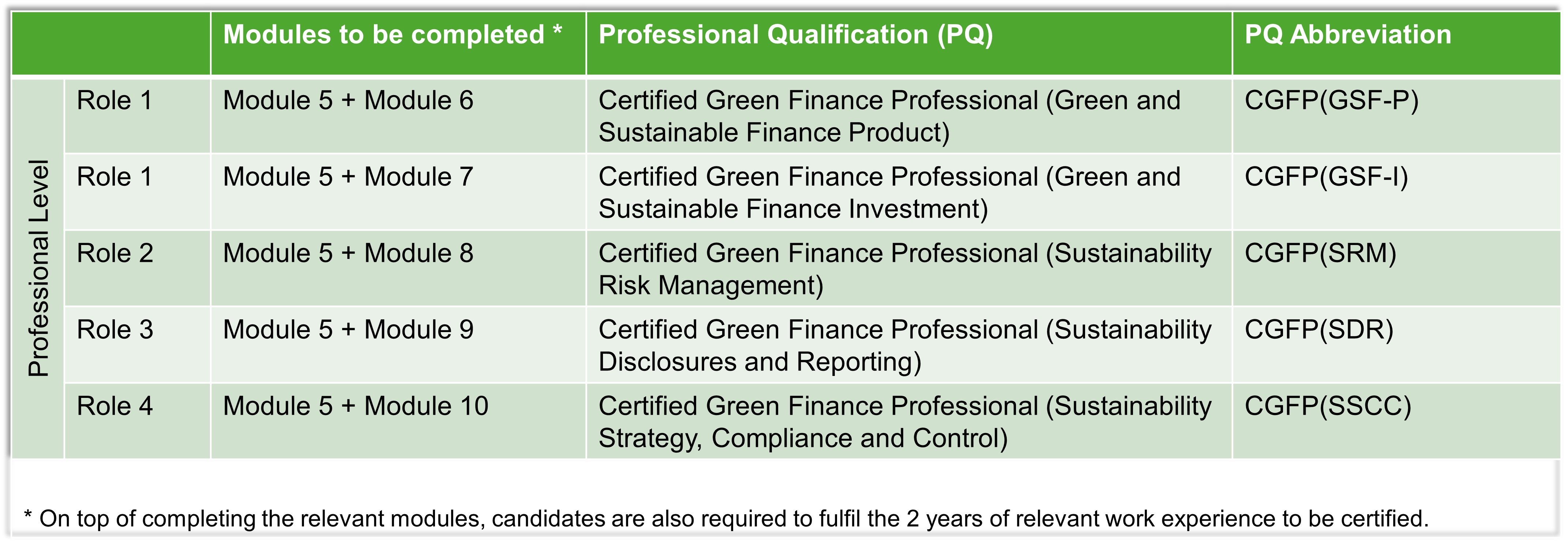

Certification

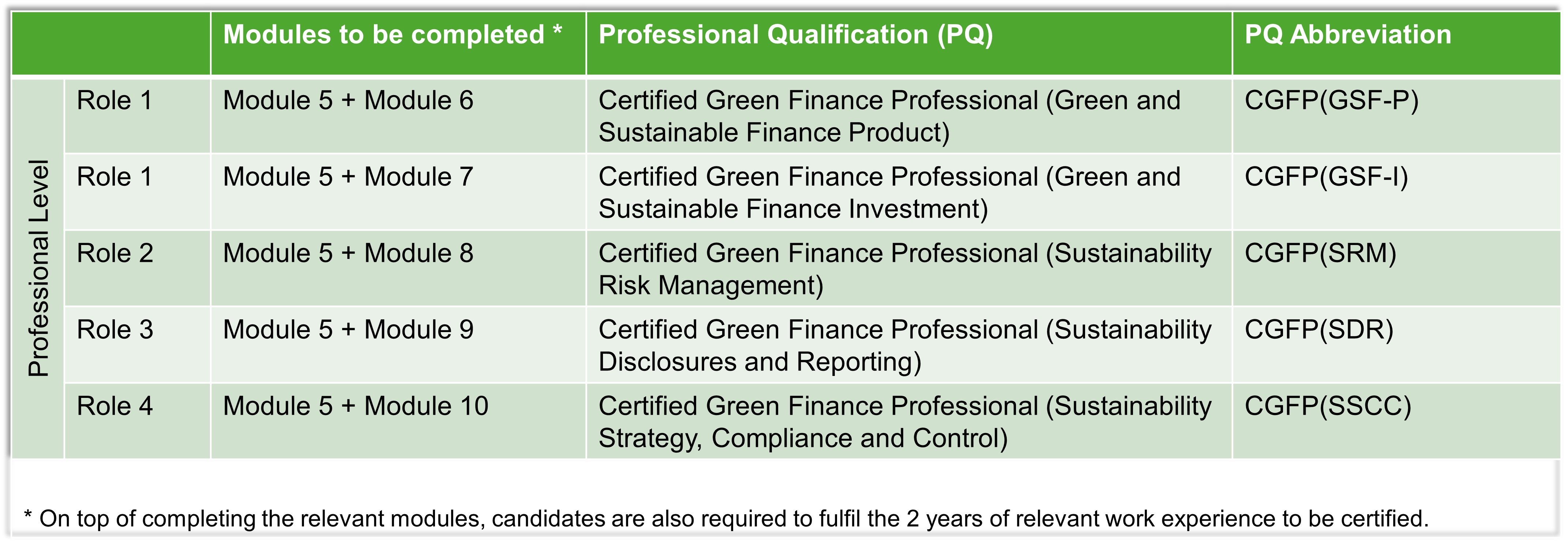

Upon completion of specific modules (complete training + pass examination) and fulfil respective certification requirements, practitioners can apply various professional qualifications as shown below:

(For Core Level, please click HERE.)

Grandfathering

Core Level

The application period of Core Level has been ended on 31 May 2024. For details, please click HERE.

Professional Level

Practitioners are eligible to apply for a one-off grandfathering from 1 March 2025 to 31 August 2025 (6 months ONLY). The detailed grandfathering requirements are as follow:

Candidates can apply for grandfathering arrangement through HKIB, and the application form will be ready soon.

Modular Exemption

An RP who has passed any of the certain training programme(s) is eligible to apply for exemption on modular basis. For details, please refer to the Module Exemption Form for HKIB Programmes.

Training Exemption (for in-house training programme)

If an RP has completed an in-house training programme organised by an AI with substantially overlapping syllabus coverage with that of the ECF-GSF, he/she can directly enrol in the examination(s) for relevant training module(s) organised by the HKIB. Upon obtaining a pass in the aforesaid examination(s), he/she is required to submit a declaration form to the HKIB to fulfil the certification requirement for completion of the ECF-GSF module(s) concerned. (Examination fee(s) will apply and relevant proof for the in-house training may be required upon request by the HKIB whenever necessary.)

Annual Renewal of Certification and CPD Requirements

The ECF-GSF certification is subject to annual renewal by the HKIB and the renewal of the certificate holder’s membership of the HKIB. An RP is required to:

- complete the annual continuing professional development requirement; and

- pay an annual certification fee to renew his/her ECF-GSF certificate.

For the Core and Professional Level qualification, a minimum of 12 CPD hours is required for each calendar year (ending 31 December), of which at least 5 hours should be on topics related to GSF.

For the qualified CPD activities and topics, please refer to the HKMA's Guide to Enhanced Competency Framework on Green and Sustainable Finance.

Scholarship

Each year, we select the top two candidates from each competency level (Core/Professional Level) and award them with the scholarship as recognition. It's our way to promote academic excellence and motivate future students to push themselves to achieve same high level of performance. The two top candidates in each competency level (COre/Professional Level), provided that all other granting requirements are met, can be awarded with a cash incentive (HKD4,000 for Core Level; HKD5,000 for Professional Level), and a study coupon which can provide candidates to study one more professional qualification offered by HKIB with all training and examination fees waived.

General Enquiry/ Feedback

|

|

Hotline

|

Email

|

|

Enquiry

|

(852) 2153 7800

|

cs@hkib.org

|

Please click HERE to view the schedule in PDF. (Coming Soon)

.png)