Overview

With the aim of supporting capacity building and talent development for banking professionals, the Hong Kong Monetary Authority (HKMA) has been working together with the banking industry to introduce an industry-wide competency framework - "Enhanced Competency Framework (ECF) for Banking Practitioners" in Hong Kong.

Since the implementation of ECF in 2018, various programmes for different job functions in banking industry have been developed and integrated into The Hong Kong Institute of Bankers' ("HKIB") flagship Certified Banker (CB) Programme which offer generalist, specialist, and strategic topics. The rationale for putting all programme under one professional banking qualification is to promote an industry-based common qualifications benchmark. While ECF programmes offer "role-based" knowledge and certification to relevant practitioners, CB is offering a vocational qualification pathway for further career advancement, being continuously enhanced to nurture more holistic banking professionals and ultimately, supporting the industry to develop a continuous learning culture and a sustainable talent pool so as to maintain the competitiveness of Hong Kong as an international financial centre.

The Enhanced Competency Framework on Retail Wealth Management (hereinafter referred to as “ECF-RWM”) is a non-statutory framework which sets out the common core competences required of retail wealth management practitioners in the Hong Kong banking industry. The objectives of the ECF-RWM are twofold:

- to develop a sustainable talent pool of retail wealth management practitioners for the banking industry and

- to raise and maintain the professional competence of retail wealth management practitioners in the banking industry.

Although the ECF-RWM is not a mandatory licensing regime, authorised institutions (“AIs”) are encouraged to adopt it for the following purposes:

- to serve as a benchmark to determine the level of competence required and assess the ongoing competence of individual employees;

- to support relevant employees to attend training programmes and examinations that meet the ECF-RWM benchmark;

- to support the continuing professional development of individual employees; and

- to specify the ECF-RWM as an industry-recognised qualification including for recruitment purposes.

Please refer to the HKMA circular on “Enhanced Competency Framework on Retail Wealth Management” for details.

Scope of Application

The ECF-RWM is intended to apply to “Relevant Practitioners” (PRs), including new entrants and existing practitioners, engaged by AIs to perform the following roles in retail wealth management function:

- Promote insurance and financial products to retail customers

- Deliver investment, insurance or wealth management services to retail customers, taking into account customers’ circumstances

|

- Oversee policies, procedures and controls for suitability assessments and selling practices

- Supervise Know Your Customer (KYC) processes and review customer risk profiling

|

Remark: Under the ECF on RWM, KYC processes refer to those aiming at understanding the risk profiles of customers and assessing the suitability of financial products rather than mitigating the risk of money laundering or financing of terrorism.

Details of the respective roles are classified by a two-level qualification structure namely Core Level and Professional Level. Please refer to Highlights of Competencies for Key Roles of Relevant Practitioners in Retail Wealth Management for details.

Competency Standards

The competency standards of ECF-RWM are set at two levels:

(a) Core Level – applicable to entry-level staff responsible for carrying out frontline customer relationship and retail wealth management duties

(b) Professional Level – applicable to staff who are able to discharge frontline customer relationship and retail wealth management duties on their own or assume additional risk management and control duties as supervisors.

Certification

Relevant Practitioners may apply to HKIB for certification as Associate Retail Wealth Professional (ARWP) or Certified Retail Wealth Professional (CRWP) with HKIB professional membership under the following conditions:

ARWP – A Relevant Practitioner may apply to the HKIB for the Professional Qualification if he or she (1) has completed the training modules and passed the examination for the Core Level or (2) has been grandfathered based on the required work experience and qualification upon the launch of the Core Level training modules.

CRWP – A Relevant Practitioner may apply to the HKIB for the Professional Qualification if he or she (1) has completed the training modules and passed the examination for the Core and Professional Levels and has at least 2 years of relevant work experience or (2) has been grandfathered based on the required work experience and qualification upon the launch of the Professional Level learning modules. The two-year relevant work experience required for CRWP certification should be accumulated within the four years immediately prior to the date of application for certification, but does not need to be continuous.

ECF Affiliate:

Learners who have successfully completed a HKIB professional qualification programme (including training and examinations requirements) but yet to fulfil the requirement of Relevant Practitioners or required years of relevant work experience for certification will be automatically granted as ECF Affiliate. Ordinary Membership with membership fee for the awarding year waived will also be granted to learners.

For details about ECF Affiliate, please contact HKIB at (852) 2153 7800 or email at cs@hkib.org

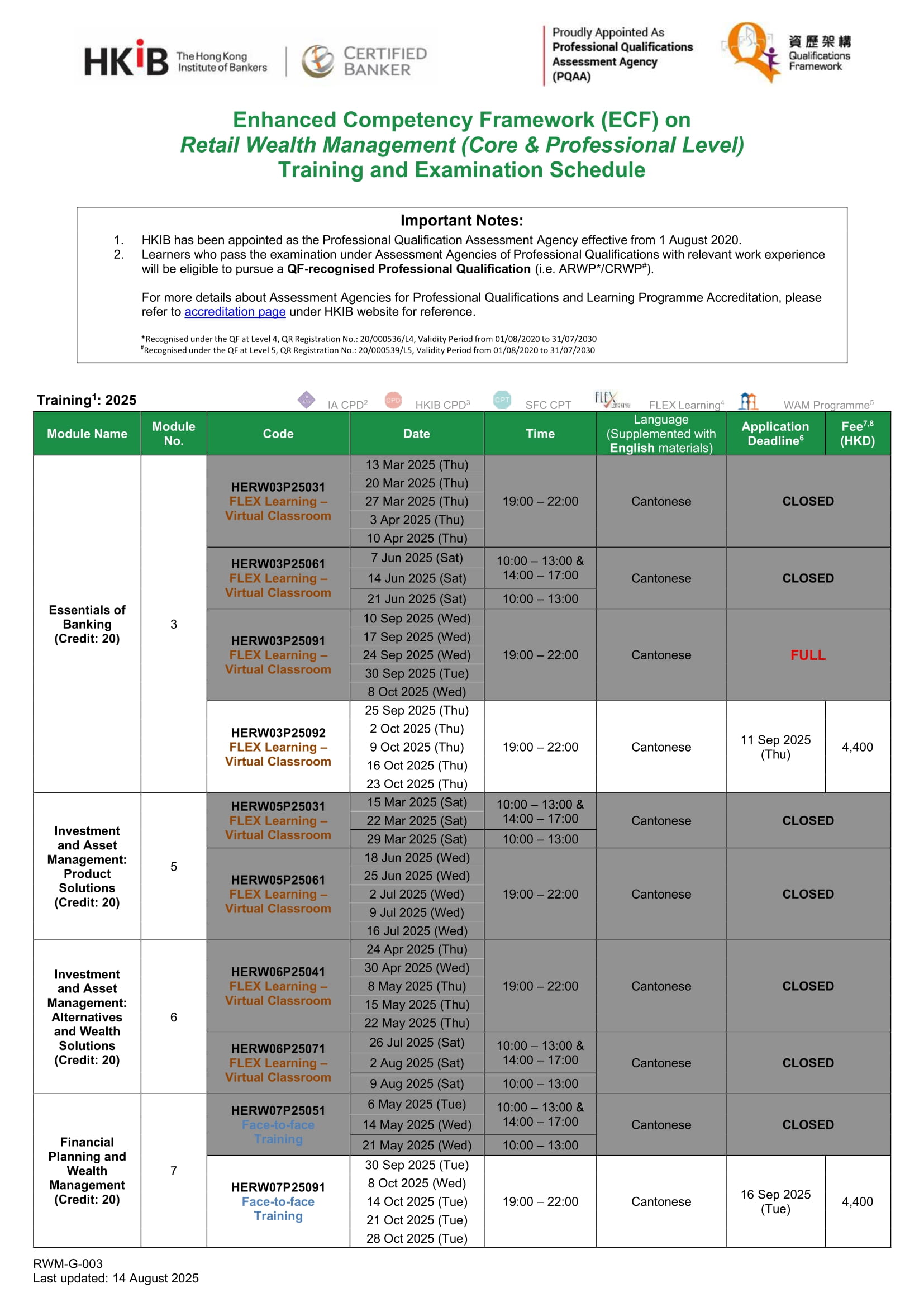

Training and Examinations

Core Level

The Core Level of the ECF on RWM consists of 4 modules, providing new entrants and staff with an introduction to Retail Wealth Management. Eligible candidates may apply for exemption from completing individual training module (Module 1, 2 and 4).

Professional Level

The Professional Level of the ECF on RWM aims to develop the knowledge of more experienced practitioners. This level of qualification can be achieved by completing Modules 5 to Module 7 of the ECF on RWM learning programme on top of the Core Level training module. Please note that you are required to complete the training and examination of Module 1 to Module 6 before applying the training for Module 7.

Candidates must first complete the training modules then proceed to the examinations. After passing the examination in all modules, candidates would be awarded the "Professional Certificate for ECF on Retail Wealth Management (RWM)".

Grandfathering

Relevant Practitioners who have been grandfathered are eligible to be certified as ARWPs or CRWPs. Please refer to the “Guidelines of ECF on RWM Grandfathering” for details on grandfathering eligibility criteria and requirements. Relevant Practitioners can apply for certification upon approval in one-off grandfathering. (The grandfathering period ended on 31 December 2018).

For other individuals performing RWM roles but not working in an AI during the grandfathering period, they may submit their applications to the HKIB for grandfathering within three months from the date of joining the RWM job function of an AI and becoming Relevant Practitioners. However, they should have met all the applicable grandfathering criteria on or before the applicable dates prescribed above.

Registration of ARWP/CRWP

ARWP and CRWP holders are registered as Certified Individuals and included in the public register on the HKIB website. Upon successful application for ARWP/CRWP certification, HKIB will grant the ARWP/CRWP holder a professional membership. Details please refer to "Guidelines of Certification Application for ARWP/CRWP".

Annual Renewal

Certification of ARWP and CRWP is subject to annual renewal by HKIB. ARWP and CRWP holders are required to meet the annual Continuing Professional Development (CPD) requirements and pay an annual certification fee to renew their ECF on RWM certification. For details, please refer to CPD Requirements section below.

CPD Requirements

For both the ARWP and CRWP holders, a minimum of 10 CPD hours is required for each calendar year (ending 31 December). At least 3 CPD hours out of the 10 CPD hours must be earned from activities related to topics of compliance, code of conduct, professional ethics or risk management.

For ECF Affiliate, at least 3-hours of CPD within the scopes mentioned in HKIB CPD Scheme is required annually for recertification.

Any excess CPD hours accumulated within a particular year cannot be carried forward to the following year.

No CPD is required in the year when the ARWP/CRWP Certification is granted. The CPD requirement starts in the following calendar year.

Training and Examination for ARWP/CRWP

Candidates must first complete the training modules then proceed to the examinations. After passing the examinations in all modules, candidates would be awarded the “Professional Certificate for ECF on Retail Wealth Management (RWM)”.

Module Outline

The module outlines are as follows:

| 1 |

Regulatory Environment for Banking and Financial Planning |

Core Level |

| 2 |

Investment Planning |

Core Level |

| 3 |

Essentials of Banking |

Core Level |

| 4 |

Insurance and Retirement Planning |

Core Level |

| 5 |

Investment and Asset Management: Product Solutions |

Professional Level |

| 6 |

Investment and Asset Management: Alternatives and Wealth Solutions |

Professional Level |

| 7 |

Financial Planning and Wealth Management |

Professional Level |

Please refer to programme brochure and Programme Handbook - ECF on RWM for details.

Training and Examination Enrolment

Applicants can submit the application via MyHKIB.

Late training enrolment will be accepted after the stipulated application deadline up to 7 days before course commencement to allow us to administer the application. A late entry fee of HKD200 (in addition to the training fee) will apply.

Late examination enrolment will be accepted after the stipulated application deadline up to 14 days before examination date, to allow us to administer the application. A late entry fee of HKD200 (in addition to the examination fee) will apply.

| 15 Hours* (per module) |

| HKD4,400 (per module)# |

*15-hour is set as the standard training duration for each module. If you have any special request and situation for a different training duration, please contact HKIB staff for details.

#A digital version of Study Guide and PPT Slides will be provided before the training commencement. Printed version will only be available at an additional cost of HKD600 (including delivery fee) on request by learners.

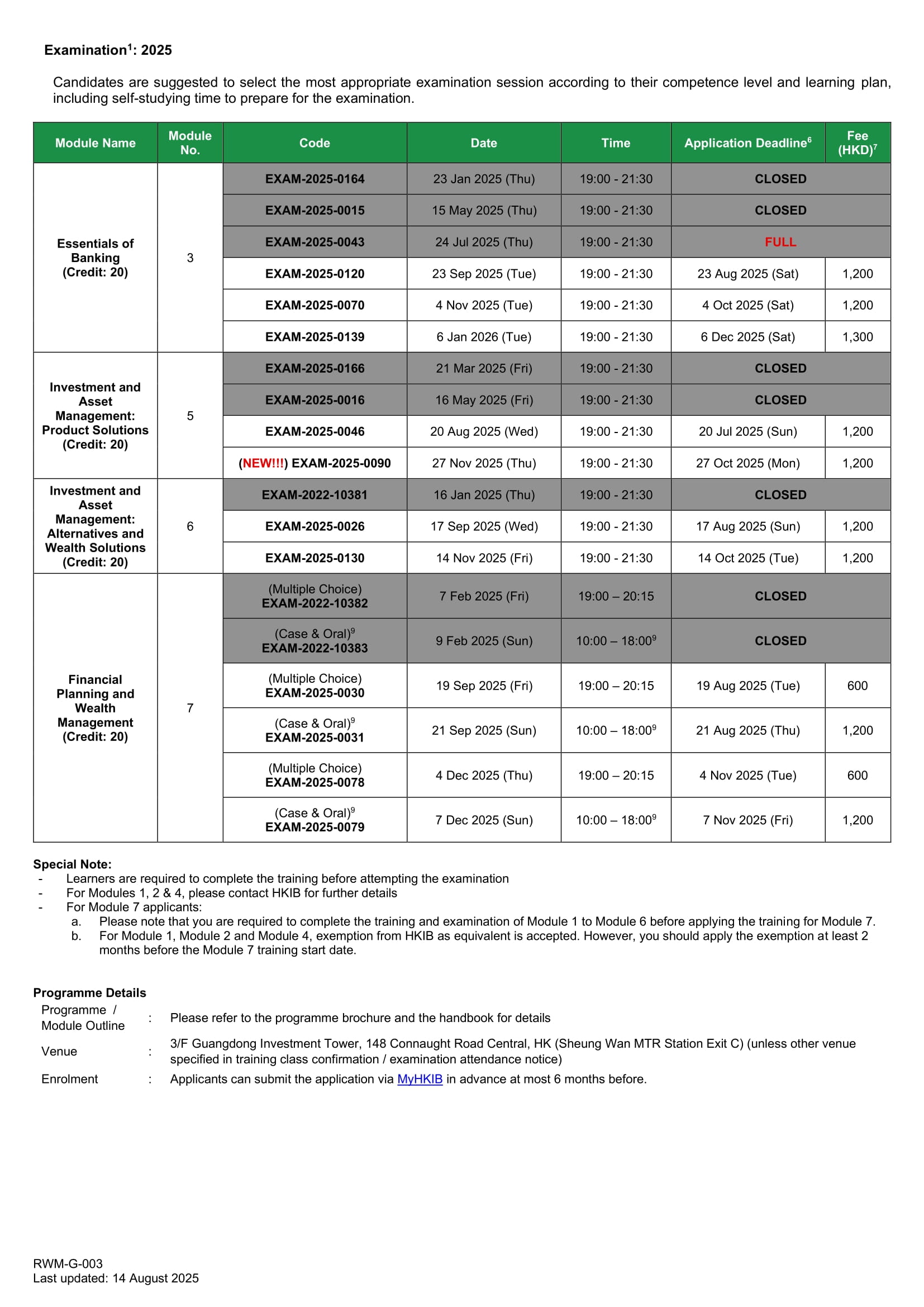

| Paper-based Examination |

Paper-based Examination |

Part A: Paper-based Examination

Part B: Case and Oral Examination |

| 2 hours 30 minutes |

2 hours 30 minutes |

Part A: 1 hour 15 minutes

Part B: 2 hour 15 minutes |

| Multiple-choice Questions (MCQs) |

Multiple-choice Questions (MCQs) |

Part A: MCQs

Part B: Case study and Oral Examination |

| 80 MCQs |

80 MCQs |

Part A: 40 MCQs

Part B: 1 Case study |

| 70% |

60%# |

60%# |

First attempt: HKD1,200 per module

Re-sit: HKD1,200 per module |

First attempt: HKD1,200 per module

Re-sit: HKD1,200 per module |

First Attempt: HKD1,800 (Part A + Part B)

Re-sit: Part A: HKD600

Re-sit: Part B: HKD1,200 |

^HKIB student members can enjoy 25% off training fee discount and 50% off examination fee discount respectively.

#Pass mark only valid for exams held after 1 August 2025.

Entry Requirement

The Programme is open to members and non-members of the HKIB. Candidates must fulfill the stipulated minimum entry requirements:

- Students of Associate Degree (AD)/Higher Diploma (HD) in any discipline (QF L4); OR

- Equivalent qualifications or above; OR

- Mature applicants* with at least 3 years of relevant banking experience with recommendations from employer.

*Mature applicants (aged 21 or above) who do not possess the above academic qualifications but with relevant banking experience and recommendation from their employers will be considered on individual merit.

Schedule

Please refer to the training and examination schedule for details.

Exemption

Candidates holding the following qualifications may apply for modular exemption of Modules 1, 2 and/or 4.

| Module 1 – Regulatory Environment for Banking and Financial Planning |

SFC Licensing Examination Paper 1 |

| Module 2 – Investment Planning |

SFC Licensing Examination Paper 7 & 8 |

| Module 4 – Insurance and Retirement Planning |

Insurance Intermediaries Qualifying Examination (IIQE) Paper “I, II and III” or “I, III and V” |

Please refer to "Modular Exemption Form for HKIB Programmes" for more details.

Integration of ECF in Certified Banker (CB)

Certified Banker (CB) is a new professional banking qualification programme developed and offered by HKIB. This common qualification benchmark is intended to raise the professional competency of banking and financial practitioners in Hong Kong to meet modern demands, while providing a transparent standard with international recognition. “ECF-RWM (Professional Level) has already been incorporated in CB (Stage II). You may refer to the CB Programme structure to plan for your learning path. Learners who have obtained a pass at the relevant examination can then apply for an exemption for the elective module “ECF-RWM (Professional Level)” of the CB (Stage II) programme.

Subsidy & Scholarship

Subsidy

ECF-RWM is one of the eligible training programmes under the Pilot Programme to Enhance Talent for the Asset and Wealth Management Sector (the WAM Pilot Programme). Eligible candidates working in the wealth and asset management industry can apply for the scheme.

For details, please visit HKIB Supports on Government Subsidy Page.

Professional Qualification Programme Scholarship Scheme

Each year, we select the top two candidates from each competency level (Core/Professional Level) and award them with the scholarship as recognition. It's our way to promote academic excellence and motivate future students to push themselves to achieve same high level of performance. The two top candidates in each competency level (Core/Professional Level), provided that all other granting requirements are met, can be awarded with a cash incentive (HKD4,000 for Core Level; HKD5,000 for Professional Level), and a study coupon which can provide candidates to study one more professional qualification offered by HKIB with all training and examination fees waived.

Enquiry / Feedback

| (852) 2153 7800 |

| cs@hkib.org |

.png)