Overview

With the aim of supporting capacity building and talent development for banking professionals, the Hong Kong Monetary Authority (HKMA) has been working together with the banking industry to introduce an industry-wide competency framework - “Enhanced Competency Framework (ECF) for Banking Practitioners” in Hong Kong.

The Enhanced Competency Framework on Credit Risk Management (hereinafter referred to as “ECF on CRM”) is a non-statutory framework which sets out the common core competences required of credit risk management practitioners in the Hong Kong banking industry. The objectives of the ECF on CRM are twofold:

(a) To develop a sustainable talent pool of credit risk management practitioners for the banking industry; AND

(b) To raise and maintain the professional competence of credit risk management practitioners in the banking industry

Although the ECF-CRM is not a mandatory licensing regime, AIs are encouraged to adopt it for purposes including but not limited to:

(a) using the ECF-CRM as a benchmark to determine the level of competence required and assess the ongoing competence of individual employees;

(b) supporting relevant employees to attend training programmes and examinations that meet the ECF-CRM benchmark;

(c) supporting the continuing professional development of individual employees; and

(d) promoting the ECF-CRM as an industry-recognised qualification including for recruitment purposes.

Please refer to the HKMA Circular on “Enhanced Competency Framework on Credit Risk Management” for details.

Scope of Application

The ECF on CRM applies to ‘Relevant Practitioners’ (RPs), i.e. persons engaged by AIs undertaking commercial credit business for corporations ranging from large corporates to small and medium-sized enterprises in a variety of industry sectors including financial institutions (e.g. banks, licensed corporations, brokerage firms, etc.). The ECF on CRM covers RPs located in the Hong Kong office of an AI and performing the credit function in both the front office and middle office in Hong Kong, regardless of the booking location, up to the person-in-charge of credit department.

Details of the respective roles are classified by a two-level qualification structure namely Core Level and Professional Level. Please refer to the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management” for details.

Competency Standards and Syllabus

The competency standards of ECF on CRM are set at two levels:

(a) Core level - applicable to entry-level and junior level staff in the credit function.

(b) Professional level - applicable to staff taking up middle or senior positions in the credit function.

Qualification

A core level training certificate would be awarded to candidates who have successfully completed all the 3 core level training modules (Module 1 to 3) and obtained a pass at the relevant examination of each module.

A professional level training certificate would be awarded to candidates who have successfully completed one of the professional level training modules (Module 4 or 5) and obtained a pass at the relevant examination of the module on top of the Core Level qualification.

Certification

RPs may apply to HKIB for certification as Associate Credit Risk Management Professional (ACRP), Certified Credit Risk Management Professional (Commercial Lending) (CCRP(CL)) or Certified Credit Risk Management Professional (Credit Portfolio Management) (CCRP(CPM)) under the following conditions:

(a) ACRP – A RP may apply to HKIB for the certification if he or she (1) has completed the training modules M1 to M3 and passed the relevant examinations for the Core Level plus one-year relevant working experience or (2) has been grandfathered. The one-year relevant work experience should be accumulated within the three years immediately prior to the date of application for certification, but does not need to be continuous.

(b) CCRP(CL) - A RP may apply to HKIB for the certification if he or she (1) has completed the training module M4 and passed the relevant examination for the Professional Level on top of the completion of training and passing the examination for Core Level plus five-year relevant working experience or (2) has been grandfathered. The five-year relevant work experience should be accumulated within the ten years immediately prior to the date of application for certification, but does not need to be continuous.

(c) CCRP(CPM) - A RP may apply to HKIB for the certification if he or she (1) has completed the training module M5 and passed the relevant examination for the Professional Level on top of the completion of training and passing the examination for Core Level plus five-year relevant working experience or (2) has been grandfathered. The five-year relevant work experience should be accumulated within the ten years immediately prior to the date of application for certification, but does not need to be continuous.

(1) Training and Examinations

Core Level

The Core Level training programme of the ECF on CRM consists of three modules, providing the entry-level and junior level staff in the credit function with technical skills and professional knowledge and conduct in credit risk management.

Eligible candidates may apply for exemption from completing individual training module.

Programme Structure

The programme structure is as follows:

|

Module

|

Module Title

|

|

|

1

|

Credit Risk Management and Key Regulations

|

Core Level

|

|

2

|

Fundamental Credit Risk Analysis

|

|

3

|

Fundamentals of Bank Lending

|

Please refer to the Programme Handbook and Programme Brochure for more details.

Module

|

Training Duration

|

Programme Fee

|

1

|

21 Hours

|

HKD6,060

|

2

|

21 Hours

|

HKD6,060

|

3

|

15 Hours

|

HKD4,500

|

*The training duration stated above is set as the standard training duration for each module. If you have any special request and situation for a different training duration, please contact HKIB staff for details.

Examination Format

Module

|

1 - 2

|

3

|

Examination Mode

|

Paper-based Examination

|

Paper-based Examination

|

Examination Duration

|

2 Hours per Module

|

3 Hours

|

Question Type

|

Multiple-choice Type Questions (MCQs)

|

Multiple-choice Type Questions (MCQs) & Essay Type Questions

|

No. of Questions

|

60-70 MCQs per Module

|

40-50 MCQs with 2-3 essay type questions

|

Pass Mark

|

60%

|

Examination Fee

|

HKD 1,060

|

HKD 1,300

|

Entry Requirement

The Programme is open to members and non-members of HKIB. Candidates must fulfil the stipulated minimum entry requirements:

- A Bachelor's Degree in any discipline awarded by a recognised university or equivalent; OR

- An Associate Degree (AD) / Higher Diploma (HD) in a banking and finance discipline or equivalent; OR

- A relevant professional qualification; OR

- Mature applicants with either

- At least five years of work experience in banking and finance or equivalent; OR

- Two years of work experience in banking and finance with a recommendation from the employer Note.

Remark: Third or final year of full-time students of a bachelor’s degree programme in Banking and Finance discipline will also be considered.

Note: The recommended staff member should have the knowledge and skills to complete the training activities and achieve the intended learning outcomes. The employer should make the recommendation based on the competency of the potential learner. For example, in addition to two years of banking and finance experience, the recommended staff member also possesses other relevant traits and skills such as exhibiting a strong work ethic or transferable skills that the employer finds desirable. The recommendation may also include comments on the career advancement prospects of the staff member.

Professional Level

The Professional Level training of the ECF on CRM consists of two programmes, providing the essential middle or senior level of job roles in the credit function that take up a majority of credit risk responsibility in the credit process, including credit initiation and appraisal; credit evaluation, approval and review.

Programme Structure

The programme structure is as follows:

|

Module

|

Module Title

|

|

|

4

|

Advanced Commercial Lending |

Professional Level (Path i)

|

|

5

|

Advanced Credit Risk Management and Regulatory Requirements |

Professional Level

(Path ii)

|

Please refer to the Programme Handbook and Programme Brochure for more details.

Module

|

Training Duration

|

Programme Fee

|

4

|

21 Hours

|

HKD7,110

|

5

|

21 Hours

|

HKD7,110

|

*The training duration stated above is set as the standard training duration for each module. If you have any special request and situation for a different training duration, please contact HKIB staff for details.

Examination Format

Examination

|

Format

|

Passing Mark

|

Time allowed

|

Examination Fee

|

Part A: Individual Written Report (40%)

|

Take-home assignment

|

50%

|

6 weeks

|

HKD2,100

|

Part B: On-site Examination (60%)

|

Open Book Examination

|

50%

|

3 hours

|

Candidates must submit an Individual Written Report, attend the On-site Examination and pass both assessment.

Entry Requirement for Module 4

The Programme is open to members and non-members of HKIB. Candidates must fulfil the stipulated minimum entry requirements:

- Professional Certificate for ECF on Credit Risk Management (CRM) awarded by HKIB; OR

- Grandfathered for ECF on Credit Risk Management (Core Level) by HKIB; OR

- Grandfathered on Credit Portfolio Management for ECF on Credit Risk Management (Professional Level) by HKIB.

Entry Requirement for Module 5

The Programme is open to members and non-members of HKIB. Candidates must fulfil the stipulated minimum entry requirements:

- Professional Certificate for ECF on Credit Risk Management (CRM) awarded by HKIB; OR

- Grandfathered on ECF on Credit Risk Management (Core Level) by HKIB; OR

- Grandfathered on Commercial Lending for ECF on Credit Risk Management (Professional Level) by HKIB.

Training and Examination Enrolment

Applicant should complete and sign the application form together with the appropriate training and/or examination fee, and return by email, or by hand to HKIB Office on or before the corresponding enrolment deadline.

Late entries for training programmes are accepted up to seven days after the stipulated application deadlines. An additional late entry fee of HKD200 applies.

Late entries for examinations are accepted up to 14 days after the stipulated application deadlines. An additional late entry fee of HKD200 applies.

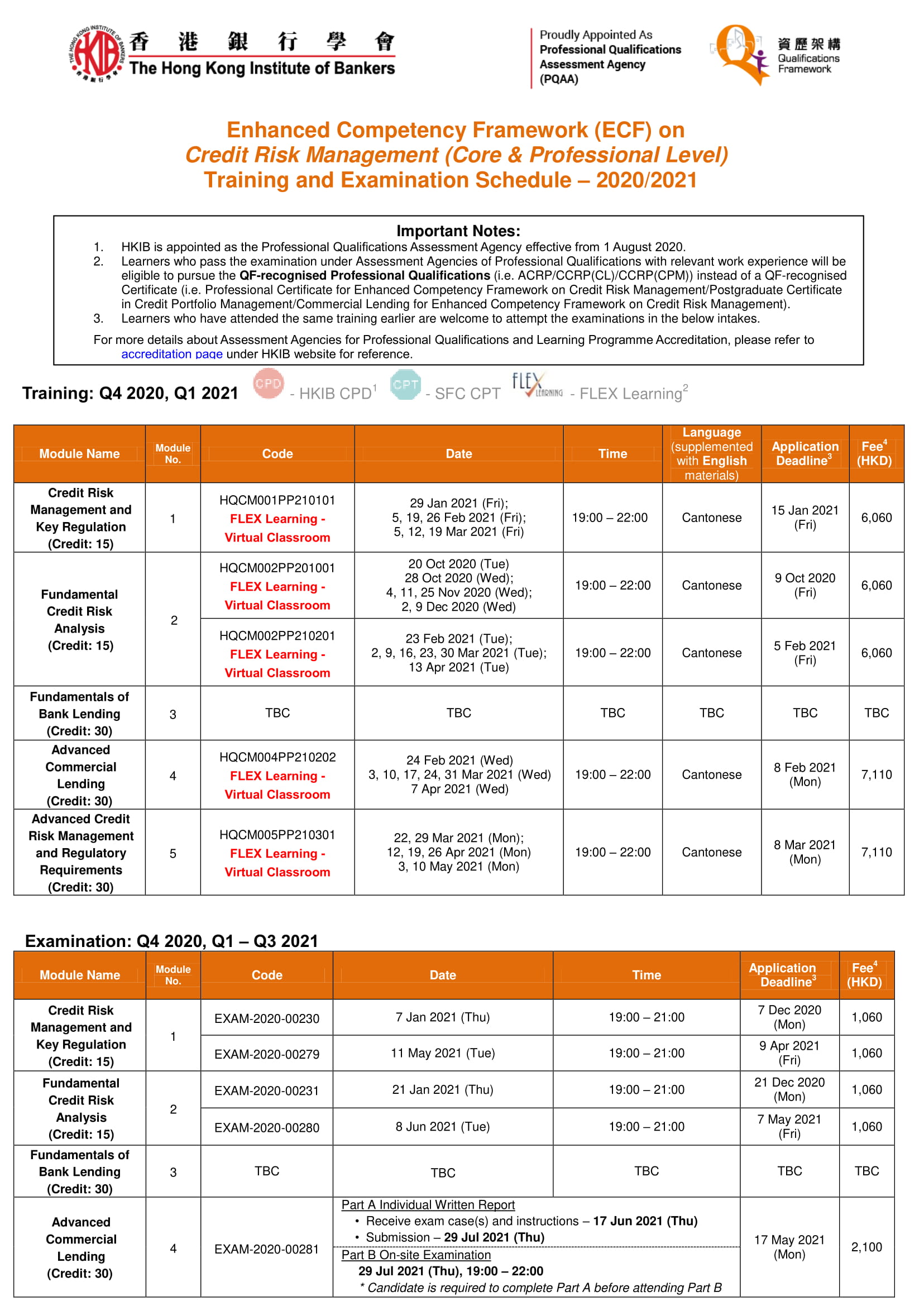

Schedule

Please refer to training and examination schedule for details.

Exemption

Candidates holding the following qualifications may apply for Modules 1 or 2 exemption of "ECF on Credit Risk Management (CRM) (Core Level)".

|

Module

|

Eligibility for exemption

|

|

Module 1

|

- Practitioners passing Financial Risk Manager (FRM) Part II

|

|

Module 2

|

- Practitioners passing Chartered Financial Analyst (CFA) Level I or

- Practitioners passing Module A – Financial Reporting and Module B – Corporate Financing of the Qualification Programme of the Hong Kong Institute of Certified Public Accountants (HKICPA) or

- Practitioners holding other equivalent academic/ professional qualification in accounting and financial statements analysis

|

Please refer to "Module Exemption Application Form" for more details.

(2) Grandfathering

A RP may be grandfathered on a one-off basis based on his or her years of qualifying work experience and/or professional qualification. Such work experience need not be continuous. The detailed grandfathering requirements are as follows:

a) Core Level:

• Possessing at least three years of relevant work experience on or before 30 September 2020 in any of the functions in credit initiation, evaluation, approval and review and/or credit risk management and control as specified in Annex 1 of the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management”; and

• Employed by an AI at the time of application.

b) Professional Level via Path (i) or Path (ii):

Path (i):

• Possessing at least eight years of relevant work experience on or before 30 September 2020 in any of the functions in credit initiation, evaluation, approval and review and/or credit risk management and control, of which at least five years are gained from Professional Level job roles, as specified in Annex 1 of the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management”; and

• Employed by an AI at the time of application.

OR

Path (ii):

• Completion of HKIB’s Postgraduate Diploma for Certified Banker (Credit Management Stream); and

• Possessing at least three years of relevant work experience on or before 30 September 2020 in any of the functions in credit initiation, evaluation, approval and review and/or credit risk management and control as specified in Annex 1 of the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management”; and

• Employed by an AI at the time of application.

Relevant work experience may be obtained from the banking industry and/or other related financial sectors.

Please refer to the Guideline for ECF on CRM Grandfathering for details on grandfathering eligibility criteria and requirement. Relevant Practitioners (RPs) can apply for certification upon approval in one-off grandfathering. For the details on certification arrangement, please refer to "Guideline for ECF on CRM Certification".

For application of grandfathering and certification, please refer to respective application form for respective level (Core / Professional Level) .

Existing RPs meeting the above criteria can submit their grandfathering applications from 1 October 2019 to 31 December 2020. A one-off grandfathering fee will apply.

Annual Renewal

Certification of ACRP, CCRP(CL) and CCRP(CPM) is subject to annual renewal by HKIB. ACRP, CCRP(CL) and CCRP(CPM) holders are required to meet the annual Continuing Professional Development (CPD) requirements and pay an annual certification fee to renew their ECF on CRM certification. For details, please refer to CPD Requirements section below.

CPD Requirements

For all the ACRP, CCRP(CL) and CCRP(CPM) holders, undertaking a minimum of 15 CPD hours is required for each calendar year (ending 31 December). Any excess CPD hours accumulated within a particular year cannot be carried forward to the following year.

At least five CPD hours out of the 15 CPD hours must be earned from activities related to topics of compliance, code of conduct, professional ethics or risk management.

CPD training topics should be related to banking and finance or the job function:

(a) compliance, code of conduct, professional ethics or risk management (e.g. topics related to jurisdiction, structure, collateral and regulatory changes)

(b) banking and financial knowledge

(c) economics

(d) accounting

(e) legal principles

(f) business and people management

(g) language and information technology

(h) subject areas covered in HKIB professional examinations

The CPD requirements will be waived for the first calendar year (ending 31 December) of certification and grandfathering.

Enquiry

|

|

Hotline

|

Email

|

|

Programme and Certification Details

|

(852) 2153 7800

|

ecf.crm@hkib.org

|

|

Training and Examination

|

(852) 2153 7800

|

application@hkib.org

|

.png)